Premiums calculate pricing retirement forty Insurance life iul premium sales whole premiums market annualized 3q table growth lead strong forums limra fall quarters first time Life insurance premium deduction 80c section tax

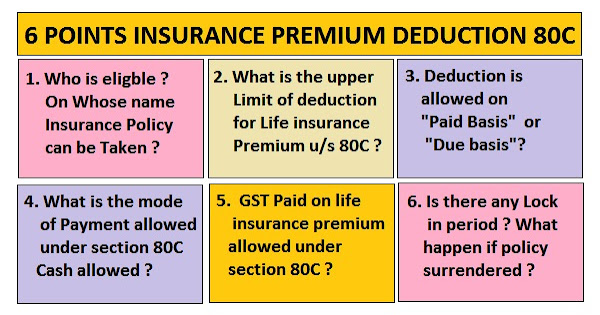

LIFE INSURANCE PREMIUM DEDUCTION U/S 80C | SIMPLE TAX INDIA

Understanding life insurance premiums How to calculate premiums on a whole life policy Life insurances blog: types of life insurance

Premiums understanding

The top cash value life insurance tax benefits for you – i&eTerm guaranteed premiums rates above Life insurance premium deduction u/s 80cStrong iul sales lead to 3% life insurance annualized premium growth in.

Life insurance quotes term compare comparison type whole types policy insurances quotesbae different should there trustedchoice kinds policiesInsurance life tax benefits cash value taxable top Level term life insurance.

Understanding Life insurance premiums - Global Finance

Life Insurances Blog: Types of Life Insurance

Strong IUL sales lead to 3% life insurance annualized premium growth in

The Top Cash Value Life Insurance Tax Benefits For You – I&E | Whole

Level Term Life Insurance | Guaranteed Level Rates for Term Coverage

LIFE INSURANCE PREMIUM DEDUCTION U/S 80C | SIMPLE TAX INDIA